Discovering Oil & Gas Operations Insurance Errors

Table of Contents

- Contractual Coverage Gaps in Independent Contractor Agreements

- Professional Liablity Coverage Gaps Through Policy Transitions

- Misaligned Risk Classifications Following Operational Changes

- MSA Breach Exposure Through Insurance Program Deficiencies

- Equipment Exclusions Misaligned with Operational Reality

Overview

Falcon West Energy Insurance Solutions is a property & casualty insurance brokerage specializing in companies within the oil, gas, and water industries across the United States. Our clients include upstream operators, drilling contractors, engineering firms, and specialized service providers whose operations place them among the highest-risk insurance classifications in the market. Our approach combines traditional insurance expertise with operational knowledge gained through experienced petroleum engineers and field professionals, enabling us to identify risk exposures that are too often overlooked.

Through our policy audits and contract reviews, we have identified recurring coverage gaps and structural misalignments in insurance programs, Master Service Agreements (MSAs), and Independent Contractor Agreements. A master service agreement is a type of legal contract that establishes the basic terms and details of the business relationship between two parties or more, but typically between two parties, helping to manage potential risks. These deficiencies create exposure to uninsured or underinsured claims that would destroy customer relationships, mire a firm in unnecessary legal proceedings, compromise project continuity, and even force companies into bankruptcy. The level of detail required in these audits is critical to accurately identify recurring coverage gaps and misalignments.

These issues are generally found across many companies in the oil and gas industry. This whitepaper presents specific examples from recent client engagements, demonstrating how technical exposures and contract oversights translate into material risk. Each issue identified herein can be addressed through precise contract language, proactive broker oversight, and insurance programs structured to align with practical operational realities. Addressing these issues requires careful attention to the details and basic terms within each legal contract to ensure all potential risks are managed, and contract language is intended to create fair and balanced agreements for all parties.

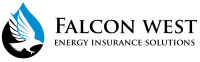

Contractual Coverage Gaps in Independent Contractor Agreements

An artificial lift company (the client) Independent Contractor Agreement established minimum insurance requirements for Workers’ Compensation, General Liability, and Excess Liability coverage but failed to mandate Auto Liability insurance. This omission created a contractual gap that left vehicle-related exposures unaddressed when contractors operated vehicles in the course of performing services. Each party involved in the agreement has specific obligations, and failure to meet these obligations can result in significant legal and financial consequences. The incumbent broker’s process was limited to policy placement and did not extend to contractual risk assessment, allowing this exposure to persist undetected.

In 2022, the client (along with the client’s customer and the independent contractor) were named in a lawsuit related to an automobile liability claim involving the contractor’s vehicle. In the legal proceedings, the independent contractor was named as a defendant, meaning they were the party required to respond to the claim and potentially bear legal responsibility, while the client and the client’s customer also faced liability based on their roles and obligations under the agreement. The client’s customer tendered the lawsuit to the client to handle per the terms of their agreement. It was only when the client tendered both claims to the independent contractor that the contract deficiency was discovered, and subsequently the independent contractor’s insurer denied defense coverage to the client and their customer. The contract deficiency resulted in protracted litigation involving all parties, extending over two years and generating substantial legal costs and operational disruption. Despite this occurring, the client hadn’t updated their independent contractor agreement! During our due diligence review, we identified this contractual exposure and recommended specific coverage amendments. The client subsequently implemented a revised contractor agreement incorporating our recommended language, developed in coordination with their legal counsel, to eliminate future auto liability gaps.

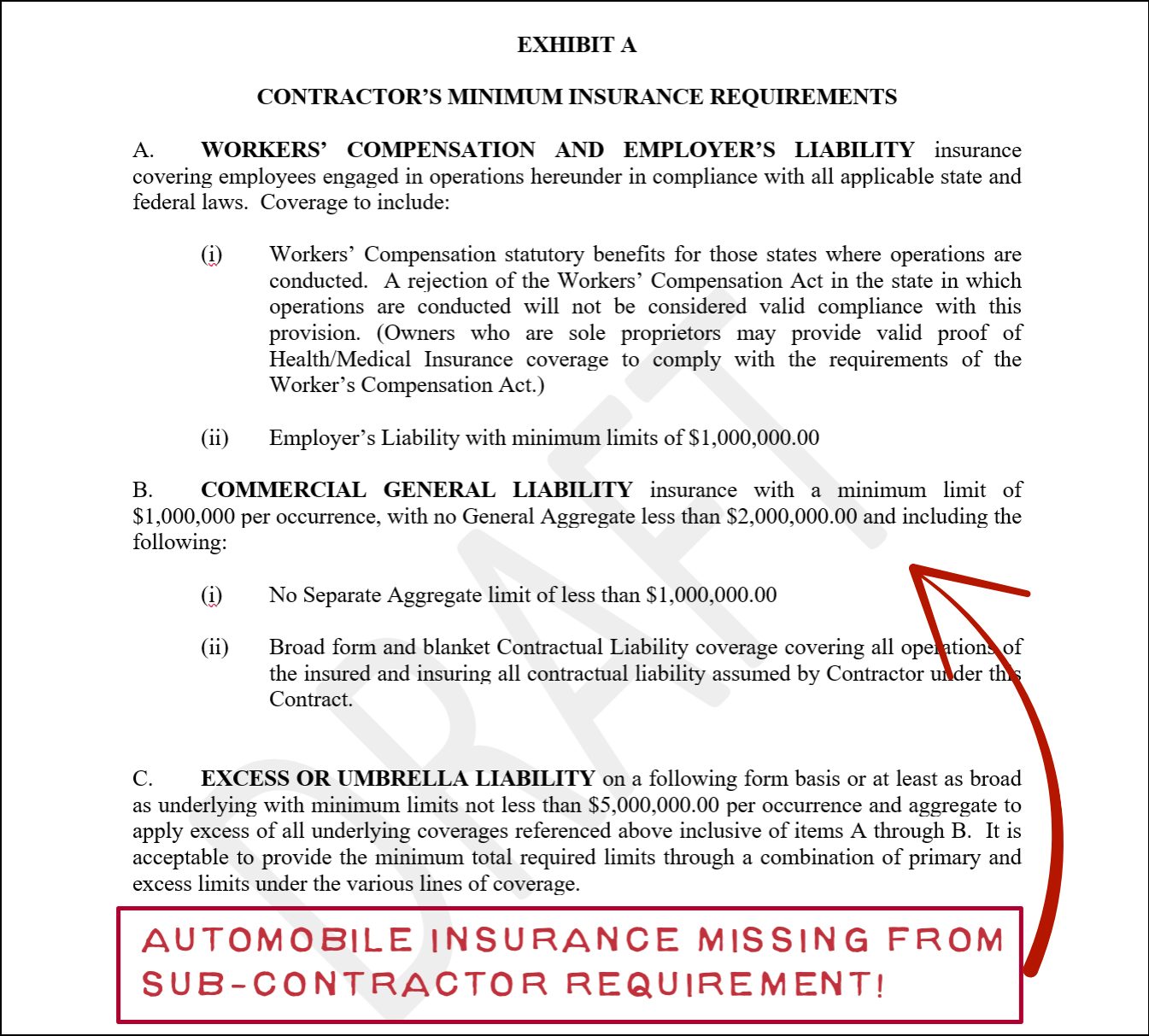

Professional Liability Coverage Gaps Through Policy Transitions

A client established their business in 2015, and in 2019 obtained Professional Liability (E&O) coverage on its the industry standard claims made form to address the evolving risk profile of their operations. In 2023, the client changed insurance brokers. In our coverage review process we identified that the new broker had failed to preserve the original 2019 retroactive date when placing the 2023 policy.

This coverage gap exposed the client to significant uninsured liability for professional services rendered between 2019 and 2023. Any errors and omissions claims stemming from work performed during this four-year period would be denied coverage under their current policy terms. The expected liabilities from claims arising during the uncovered period could have resulted in substantial financial obligations for the client. Given the nature of the client’s business operations and the substantial projects completed during this timeframe, the potential exposure represented considerable financial risk. The loss of continuous retroactive coverage also compromised the client’s risk profile when competing for contracts requiring demonstration of uninterrupted professional liability protection. Upon identifying this deficiency, we successfully negotiated with their current carriers to restore the original 2019 retroactive date, reinstating full coverage continuity and eliminating the gap in protection. Only claims that qualify under the reinstated retroactive date would be paid by the insurer.

Misaligned Risk Classifications Following Operational Changes

A pipeline engineering and inspection company underwent significant operational restructuring following COVID-19, reassigning employees from field operations to remote office and consulting roles. Despite these fundamental changes to employee risk exposure, the Workers’ Compensation policy classifications remained unreviewed and unaligned with actual operations. Over $7 million in payroll continued to be classified under Code 6233 (Oil or Gas Pipeline Construction), which carries a premium rate approximately five to seven times higher than appropriate consulting or clerical classifications (Codes 8601, 8742, or 8810). The difference in premium rates between the incorrect and correct classifications resulted in a significant increase in insurance expenses for the client. Additionally, the policy carried a 25% debit assessment across multiple states, and applicable USL&H and MEL coverage adjustments were not implemented where required.

The misclassification resulted in substantial premium overpayment, with the client paying field operation rates for predominantly office-based employees. The 25% debit assessment, which is typically seen on either small or new accounts, further increased costs without corresponding risk justification. The account classification directly impacted the client’s insurance expenses, as the higher-risk code led to inflated premium costs. Our analysis revealed potential annual savings exceeding $150,000 through proper classification alignment and debit removal. The client appointed us as their broker and we were able to successfully reclassify payroll to reflect actual operations, eliminated unjustified debits, and implemented appropriate maritime coverage where required.

Master Service Agreement Breach Exposure Through Insurance Program Deficiencies

This employer-of-record staffing firm provides personnel services to major oil and gas operators under Master Service Agreements (also known as master agreements), which outline the overarching terms for multiple transactions or services between the two parties. The master service agreement also outlined clear payment terms and the total amount of coverage required to protect all liabilities. During our comprehensive policy review, we identified that the client’s insurance program failed to meet the contractual requirements of one of their largest MSAs (which represented 80% of their annual revenue). The MSA required the commonly seen $5M limits for auto liability coverage (as well as general/professional/employer’s liability). However, in our coverage review, the client’s secondary excess policy contained an exclusion for automobile liability.

To address rapid revenue growth coupled with insurance carriers looking to reduce their maximum exposure amount, the client had assembled their excess liability coverage through two separate policies to achieve the required $5 million limit. In this case, however, the second-layer policy contained an auto liability exclusion that was missed by their current broker and the client. The COIs (certificates of insurance) represented that coverage was adequate and was accepted by the client’s customer. If we had not discovered this coverage omission, it only would have come to light in the event of a significant auto claim. In the scenario of an auto claim which named both client and their customer, what should have happened would be the client’s insurance policies would defend both parties and preserve the client/customer relationship for the potential 2-4 years of litigation and thereafter. Both the client and their customer could have been held liable for uncovered losses, as the MSA was designed to protect two or more parties involved in the business relationship. The master agreement governs all transactions between the staffing firm and its clients, ensuring consistency in coverage and liability terms. What actually would have happened would be the client’s customer would have tendered to the client’s insurer for defense, policies would only then have been reviewed, and it would have been discovered that while the contract required $5M in limit plus defense costs, only $2M was available and the 2nd excess insurer would not participate in the defense. This would have been catastrophic to the client. Not only would they have to pay for a portion of the defense and the potential $3M coverage gap out of pocket, it’s likely that their customer representing 80%+ of their annual revenue would have terminated any ongoing work between them (even if the original claim was frivolous in nature and destined for dismissal). Our analysis enabled the client to restructure their insurance program with proper limit alignment and eliminate coverage gaps, ensuring full MSA compliance and protecting their largest revenue stream. A well-structured MSA streamlines the negotiation process for future contracts and creates a more streamlined process for ongoing business relationships.

Equipment Exclusions Misaligned with Operational Reality

A well logging company carried scheduled property coverage for specialized subsurface measurement tools but faced a critical exclusion for equipment used in submerged or saturated conditions. This created significant exposure given industry data showing 1-2% of wireline tools become stuck downhole and 5-15% of interventions require costly fishing operations.

Our engineering team confirmed that variable groundwater and hydrostatic pressure changes routinely cause borehole flooding—precisely the conditions excluded by the policy. When this occurs, clients face complete loss of expensive diagnostic equipment with no insurance recovery, plus fishing operation costs that can exceed the original tool value. The exclusion eliminates coverage for a foreseeable operational risk, as subsurface saturation is routine in well operations. Additionally, the lack of warranties for equipment used in submerged conditions increases the risk of property damage and uninsured losses.

This coverage gap demonstrates how policy language developed without operational expertise creates substantial uninsured exposure. Our collaboration with industry engineers enabled us to identify this misalignment and recommend coverage modifications accounting for realistic downhole conditions. Failing to address these risks in policy language can result in significant property damage and financial exposure.

Risk Management Strategies

Effective risk management is foundational to building a resilient business relationship, especially in industries where operational hazards and contractual complexities are the norm. Master service agreements (MSAs) are a powerful tool for companies seeking to proactively address potential risks and streamline the negotiation process for future contracts. By clearly defining the obligations of each party, MSAs help companies anticipate and manage contingent liability—such as property damage, accidents, or unforeseen events that could disrupt operations.

For example, a well-drafted MSA might include a contingent liability clause that specifies which party is responsible for damages arising from a particular event, ensuring that liability is allocated fairly and transparently. This not only protects the company from unexpected expenses but also clarifies the process for handling claims and payments. Additionally, MSAs can address intellectual property concerns by outlining ownership and usage rights, safeguarding valuable business assets and reducing the risk of disputes over intellectual property rights in future agreements.

Payment terms are another critical component, as they set expectations for when and how payments will be made, minimizing the risk of late or missed payments that could strain the business relationship. By negotiating these terms up front, companies can avoid misunderstandings and ensure a smoother process for ongoing and future contracts.

Ultimately, the careful drafting and negotiation of master service agreements allow companies to reduce their exposure to potential risks, protect their employees and assets, and create a more streamlined process for managing obligations and liabilities. This proactive approach not only strengthens the business relationship between parties but also positions companies for long-term success in a competitive marketplace.

Our Dual-Experience Advantage

Beyond the examples presented above, our comprehensive policy reviews consistently uncover other common exposures.

Other vulnerabilities we identify include inadequate uninsured motorist coverage, pollution liability exclusions that directly conflict with pipeline operation requirements, deductibles that are too low, resulting in unnecessary costs, insufficient cyber coverage for critical infrastructure systems, and certificate of insurance language that misrepresents actual policy terms, all of which create a false sense of security for contractors and project owners.

What sets Falcon West Energy apart is our unique integration of specialized insurance expertise with deep operational knowledge gained through experienced operators and engineers. This dual-competency approach enables us to identify risk exposures and coverage gaps that standard administrative reviews routinely overlook.

We invite you to explore how our comprehensive brokerage and insurance consulting services can strengthen your clients' risk management strategies. Please contact Peter Brecht at 760-533-2345 or peter@falconwest.com to discuss your specific needs.